Treasury Secretary Scott Bessent has launched a massive, data-driven federal investigation targeting more than 100 money service businesses (MSBs) operating along the U.S. southwest border.

The announcement came as the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) revealed a multi-tiered enforcement operation aimed squarely at financial institutions suspected of facilitating cartel money laundering, human trafficking, and drug smuggling, especially the flow of deadly fentanyl into American communities.

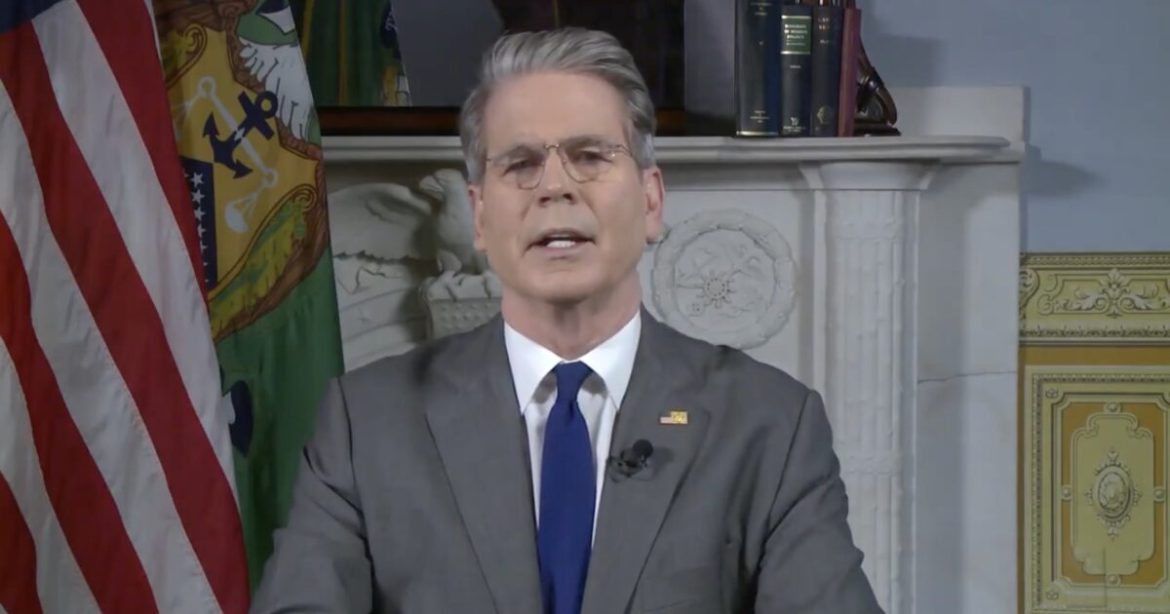

Scott Bessent made the following announcement:

“At President Trump’s direction, the Treasury Department is utilizing all tools to stop terrorist cartels, drug smugglers, and human traffickers. In line with that effort, I’m announcing a new data-driven border operation to help root out potential cartel-related money laundering from the U.S. financial system.

Treasury’s Financial Crimes Enforcement Network, known as FinCEN, is targeting over 100 money service businesses along the Southwest border. Specifically, FinCEN is issuing six notices of investigation, dozens of examination referrals to the IRS, and over 50 compliance outreach letters.

These businesses, which provide financial services outside of a formal bank, face elevated exposure to illicit activity, including money laundering related to drug smuggling and human trafficking.

Thanks to Treasury’s push for technology modernization, we are now able to implement data-driven approaches to identify potential bad actors. When malicious activity is identified, make no mistake: we can and will take action to keep Americans safe.

President Trump has made clear his commitment to securing our border, stopping the flow of deadly fentanyl, and eliminating Mexico-based drug cartels to protect Americans.

Treasury will continue to use, expand, and advance technology—and every resource at its disposal—to combat money laundering and make America safe again.”

At President Trump’s direction, the Treasury Department is utilizing all tools to stop terrorist cartels, drug traffickers, and human smugglers. This sweeping operation examining U.S. money services businesses along the southwest border will help root out potential cartel-related… pic.twitter.com/7g1aRLx4rh

— Treasury Secretary Scott Bessent (@SecScottBessent) December 22, 2025

According to Treasury officials, FinCEN’s operation has already produced serious consequences:

- Six formal notices of investigation

- Dozens of examination referrals to the Internal Revenue Service (IRS)

- More than 50 compliance outreach letters

More from the press release:

The U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) announced a multi-tiered operation targeting more than 100 U.S. money services businesses (MSBs) operating along the southwest border.

These MSBs—which provide financial services outside of a formal bank—are being examined for potential non-compliance with regulations designed to detect money laundering and combat illicit finance.

FinCEN’s operation resulted in the issuance of six notices of investigation, dozens of examination referrals to the Internal Revenue Service (IRS), and over 50 compliance outreach letters.

[…]

MSBs operating along the southwest border can face elevated exposure to illicit activity, including the laundering of proceeds from drug trafficking, smuggling of illegal aliens, and other serious crimes. This operation is consistent with President Trump’s directive to secure the border and to pursue the total elimination of Cartels and Transnational Criminal Organizations.

Ongoing Border Operation Based On Data From Over ONE Million Banking Records — May result in Monetary Penalties, irs examinations, and criminal referrals

FinCEN’s operation resulted in the issuance of six notices of investigation, dozens of examination referrals to the IRS, and over 50 compliance outreach letters.

These tiered actions are designed to address the money laundering vulnerabilities created by MSBs that appear to be non-compliant with the Bank Secrecy Act.

MSBs on the receiving end of these actions are on notice that Treasury will not tolerate Bank Secrecy Act violations that could put Americans at risk. This data-driven operation is based on a review of over one million Currency Transaction Reports and 87,000 Suspicious Activity Reports, which financial institutions are required to submit to FinCEN to provide highly useful data to law enforcement.

This is an ongoing operation in which FinCEN will follow the facts and, where appropriate, seek to impose civil money penalties, pursue civil injunctive actions, issue warning letters, and make referrals to criminal authorities for willful violations of the Bank Secrecy Act.

FinCEN is coordinating closely with the Homeland Security Task Force, the Internal Revenue Service, and both law enforcement and regulatory partners at the state and federal levels.

Treasury Deploys Cutting-Edge Technology to Target Potential Money Laundering on Southwest Border

The Trump Administration has prioritized making government more modern, effective, and efficient. Under Secretary Bessent’s leadership, Treasury has expanded its use of advanced technology to deliver results for the American people.

FinCEN is now applying high-performance data processing to uncover illicit networks and protect the U.S. financial system from evolving threats.

Treasury’s modernization efforts have strengthened FinCEN’s ability to transform fragmented financial information into reliable, decision-grade leads at scale. This commitment to technological advancement has enabled FinCEN to launch this first-of-its-kind, data-driven enforcement operation to enhance the safety of the American public.

Compliance Failures Threaten National Security

Failure to comply with the Bank Secrecy Act deprives law enforcement and national security agencies of critical financial intelligence and increases the risk that MSBs can facilitate money laundering and other criminal activity. U.S. MSBs, including those operating along the southwest border, are reminded that they must:

-

develop, implement, and maintain effective, risk-based anti-money laundering/countering the financing of terrorism programs;

-

verify customer identification as needed to fulfill Bank Secrecy Act reporting requirements;

-

monitor transactions for suspicious activity and file timely Suspicious Activity Reports;

-

file timely Currency Transaction Reports for transactions exceeding reporting thresholds; and

-

ensure adequate oversight of agents, branches, and third-party service providers, as applicable.

The post Scott Bessent Launches MASSIVE Federal Investigation Into Over 100 Money Service Businesses Operating Along the U.S. Border appeared first on The Gateway Pundit.